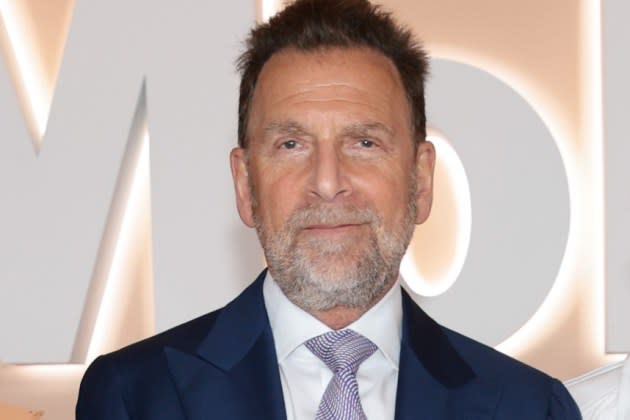

Billionaire and one-time media mogul Edgar Bronfman Jr. is still considering making an offer for Paramount Global.

A rep for Bronfman confirmed that he is evaluating options for a potential bid for Paramount. His continued interest in the media conglomerate was first reported by Axios.

More from Variety

On July 7, Paramount Global and Skydance Media, David Ellison’s smaller media and production company, announced a two-part transaction that will result in Skydance buying out Shari Redstone’s National Amusements Inc. and then merging with Paramount, whose properties include CBS, Paramount Pictures, Showtime/MTV Entertainment Studios and Paramount Media Networks. About $6 billion of the $8 billion to fund the deal is coming from the family of Oracle founder Larry Ellison (David’s father) and about $2 billion is from Gerry Cardinale’s RedBird Capital Partners private-equity investment firm.

Under a “go-shop” provision in that agreement, Paramount Global has the right to solicit a better offer in a 45-day window, which expires 11:59 p.m. ET on Aug. 21. If Paramount opts to go with a rival bid, the company would be obligated to pay a $400 million breakup fee to the Skydance investor group.

Bronfman had previously engaged with investment firm Bain Capital for a potential offer of up to $2.5 billion for Redstone’s National Amusements. It’s not clear if Bain is still in the picture, nor is it known what structure a potential bid from Bronfman might look like following the Skydance-Paramount-NAI agreement.

Reps for Bain Capital, Paramount Global and the Paramount board’s special committee established to evaluate M&A proposals declined to comment.

Bronfman was chairman and CEO of Warner Music Group from 2004-12, stepping down after it was acquired by Len Blavatnik’s Access Industries. Before WMG, he was CEO of Seagram before he sold that business to Vivendi. Currently Bronfman serves as executive chairman of Fubo, the sports-focused streaming pay-TV provider, and executive chairman of Global Thermostat LLC, a company designed to develop and commercialize a technology for the direct capture of carbon dioxide.

Meanwhile, IAC chairman Barry Diller last week said “I think it is over” about his previous interest in Paramount during an interview in with CNBC in Paris ahead of the start of the Summer Olympic Games. “It is unwise to get in an auction with someone who has a pretty much unlimited balance sheet,” Diller said in the July 26 interview, referring to Larry Ellison. Diller added, “I did an auction for Paramount once. I don’t think I would do it again.” Thirty years ago, Diller was outbid for Paramount Pictures by Sumner Redstone’s Viacom, which acquired control of Paramount in a deal worth about $10 billion.

Best of Variety

Sign up for Variety’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.