Skift Take

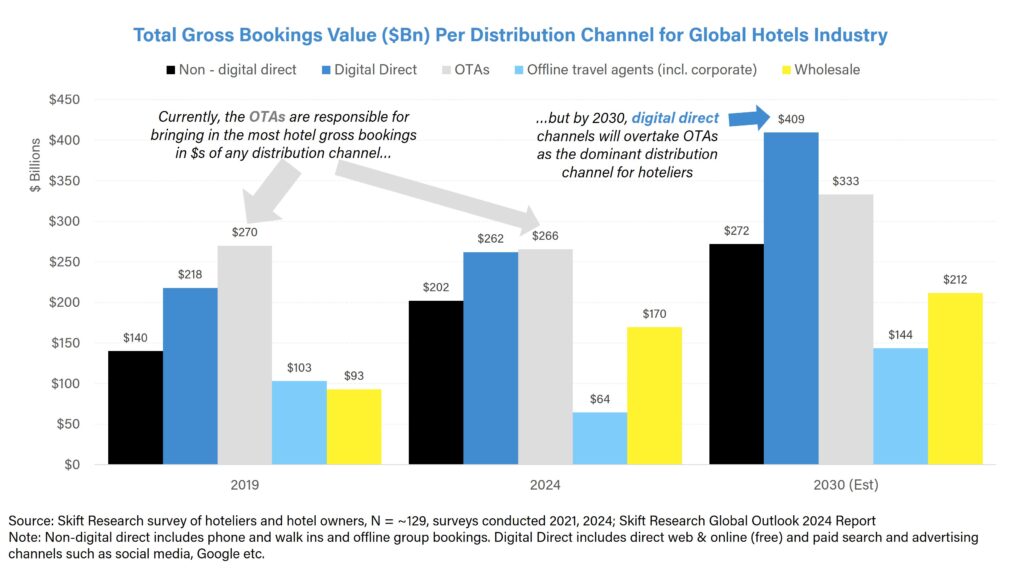

By 2030, direct digital bookings will surpass online travel agencies as the dominant distribution channel, generating over $400 billion in global hotel gross bookings.

Online travel agencies still account for the largest share of hotel gross bookings – but that’s changing fast, Skift Research shows in Hotel Distribution Outlook 2024.

We predict that by 2030, direct digital channels will have overtaken the OTAs as the dominant distribution channel for hoteliers: $409â¯billion of hotel gross bookings are expected to come from direct digital channels, compared to just $333 billion from OTAs.

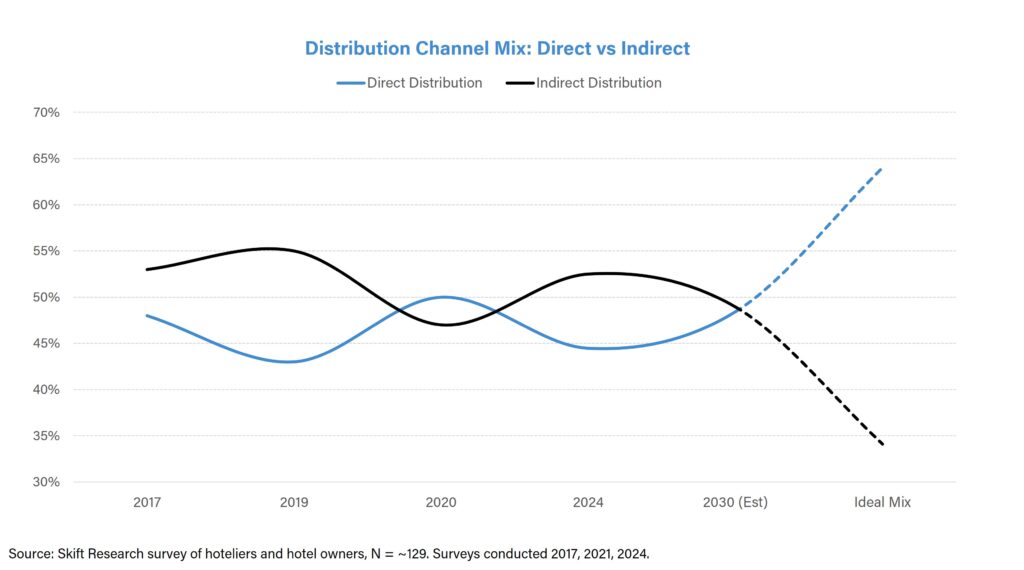

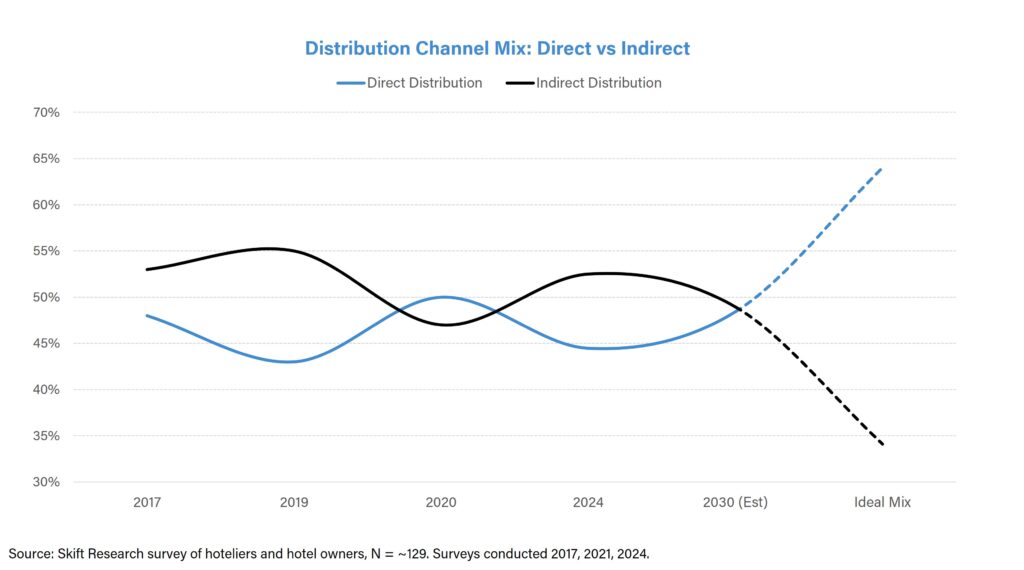

It is no surprise that hoteliers want more direct bookings: Direct bookings are generally a more profitable channel as compared to indirect bookings and they allow hoteliers to retain data about their consumers. But the contribution from indirect channels, including OTAs and travel agents, isn’t going to zero. They will remain an important part of hotels’ distribution strategy.

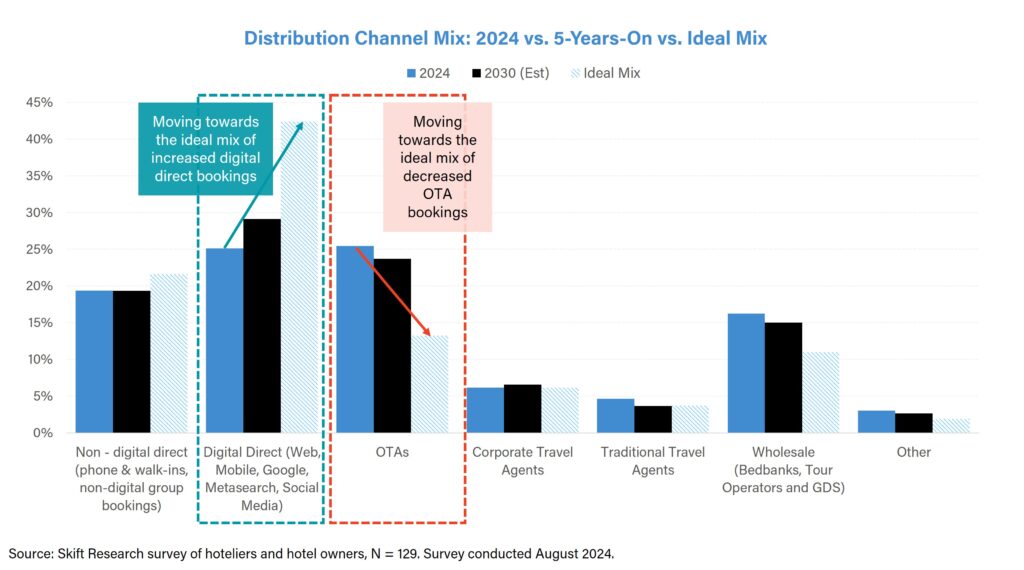

An ideal contribution from indirect channels would be 34%, according to a proprietary Skift Research survey of hotel owners and operators. That’s down from 53% in 2024.

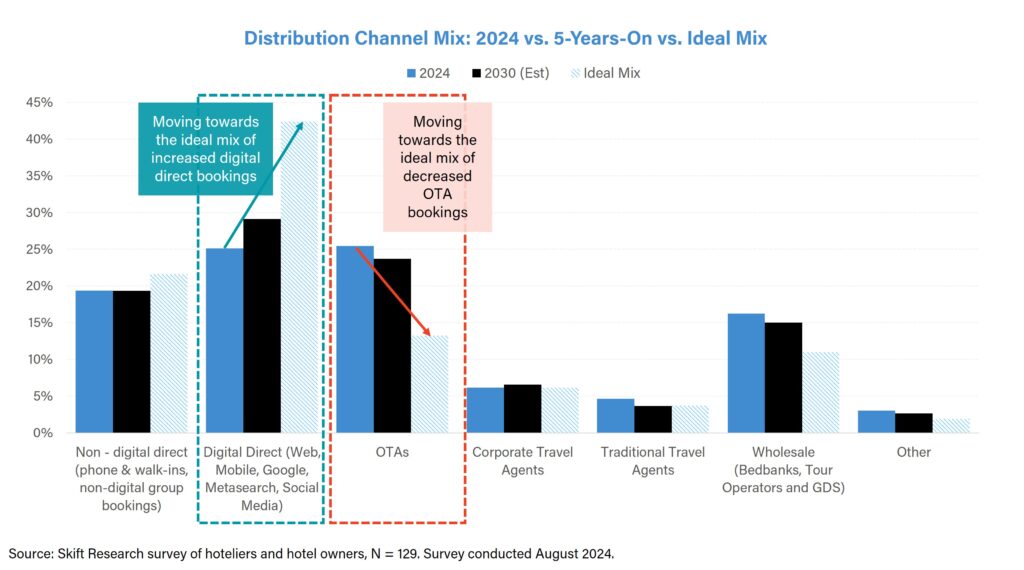

And we can see that hoteliers would like to move toward an ideal scenario with the biggest increase in digital direct bookings (from 25% in 2024 to 42%) and the biggest decrease in OTA distribution (ideally from 25% in 2024 to 13%).

Hoteliers would also like more non-digital direct bookings, particularly from offline group bookings, and a reduction in wholesale distribution. Other indirect forms of distribution, such as traditional travel agents, would also likely see a slight decrease in share of distribution mix.

Branded Chains vs. Independent Hotels

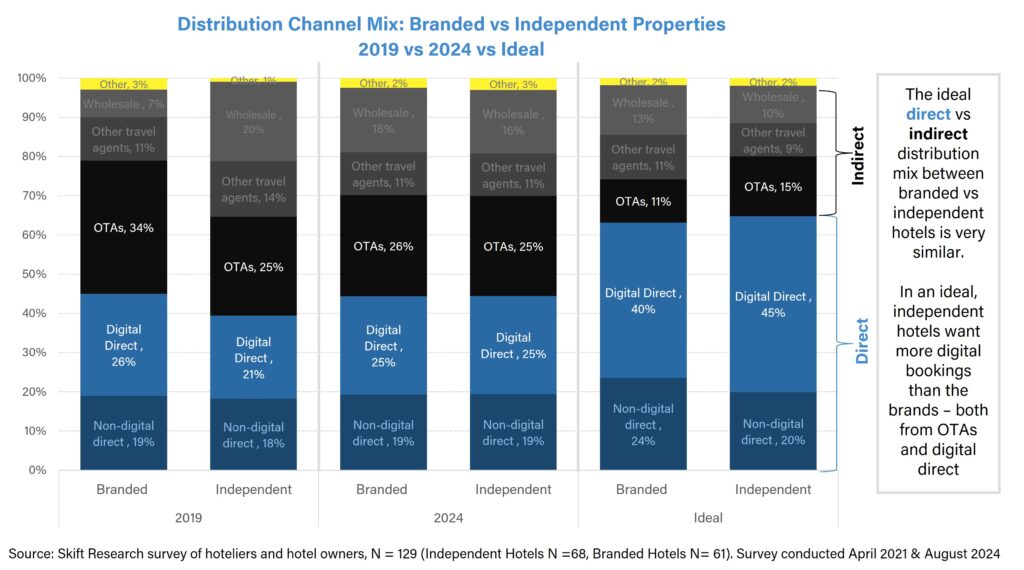

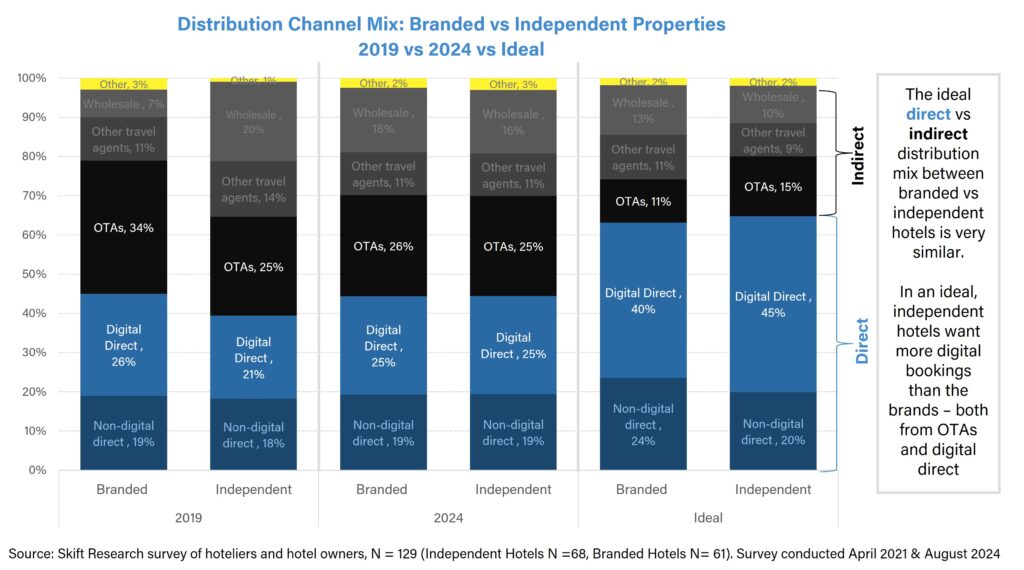

The ideal distribution channel mix is very similar for both branded and independent hotels, suggesting that a combination of direct and indirect distribution is key for any hotel. This ideal distribution mix suggests an optimization of customer acquisition, revenues, and guest relationships.

Drilling down further, we can see that independent hotels would like more digital direct bookings than the branded chains, while brands would like to see more offline direct group bookings. Independent hotels also recognize that they will be more reliant on OTA distribution than brands, with branded hotels instead wanting more indirect distribution from wholesalers as an alternative to the OTAs.

In addition, there is generally a desire for increased digitization from independent hotels: in an ideal world, they want slightly more digital bookings than branded hotels â both from OTAs and digital direct.

There is no clear-cut answer to what the perfect distribution strategy looks like, particularly in an environment that is seeing increased fragmentation in what travelers desire, how suppliers are responding to new types of demand, and how new forms of distribution are shaking up the status quo.

Fundamentally, the rise of experiential travel is leading to a more differentiated, non-commoditized hospitality offering, which is tailoring to a more personalized travel experience. Distribution is no longer just about selling hotel rooms â loyalty, experiences and personalization are increasingly becoming integral differentiators in the battle for hotel market share.

Read the full report for further analysis and insights on the outlook for hotel distribution.

What You’ll Learn From This Report

- A detailed distribution channel mix from 2017 to 2024, with hoteliersâ projections for 2030

- The level of satisfaction with current distribution and an analysis of an ideal mix

- How third-party channels such as online booking platforms will remain an integral part of distribution, despite the concerted efforts of direct-booking campaigns

- How branded hotel chains and independent properties differ in their distribution mixes

- An analysis of costs and commissions for all distribution channels

- Where loyalty programs fit in the overall distribution mix

- The drivers of direct bookings

- The biggest challenges with third-party distribution

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

Subscribe now to Skift Research Reports

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report à la carte at a higher price.